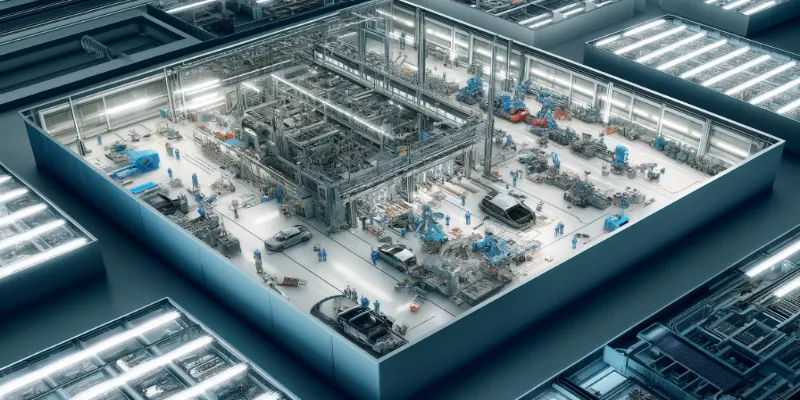

The Mexican automotive sector shines as a dynamic force in the nation's economy, providing vital employment opportunities and bolstering an extensive network of small and medium-sized enterprises (SMEs). Far from being just a national triumph, this sector exemplifies a global model of competitive harmony and collaborative progress, benefitting both local and international stakeholders, and propelling Mexico onto the global stage. Here's a deep dive into Mexico's automotive industry, highlighting its strategic advantages, major players, and the future trajectory that makes it a pivotal player on the global stage.

Mexico's Strategic Position in the Global Automotive Industry

Mexico is home to 26 automotive plants, including those from industry giants such as General Motors, Ford, Nissan, Stellantis, Volkswagen, and Hyundai. This positions Mexico as a significant player on the world stage, with projections suggesting it could become the fifth-largest automaker globally by 2025. The automotive sector not only plays a critical role in Mexico's economy by generating over a million jobs but also serves as a hub for innovation and development with more than 300 research and development centers.

The country's strategic location offers unique advantages, including proximity to the United States, one of the largest markets for automobiles. This geographical benefit is complemented by Mexico's participation in various free trade agreements, which facilitate the efficient export of vehicles and parts, further enhancing the competitiveness of automotive manufacturing in the region.

Regional Hubs and Key Players

Automotive manufacturing in Mexico is concentrated in several key regions, each offering

distinct advantages. States like San Luis Potosi, Aguascalientes, and Guanajuato are noteworthy

for their significant automotive production activities. For example, San Luis Potosi is a

central hub that features a diverse mix of OEMs such as GM, BMW, and Ford, alongside numerous

suppliers contributing to a vibrant automotive ecosystem. Mexico's infrastructure,

strategic

location, and skilled workforce make it a powerhouse in automotive manufacturing, accounting for

a substantial portion of the state's export activity.

Aguascalientes, another central figure in Mexico's automotive landscape, is home to OEMs like

Nissan, Mercedes, and Infiniti (Shown in table 1). The presence of these major automakers,

coupled with a network of over 100 Tier 1 and Tier 2 suppliers, underscores the state's

importance in the automotive sector. Nissan, for example, has a significant presence with

multiple assembly plants, emphasizing the state's role in producing a considerable fraction of

Mexico's vehicles. Here must read: What Car Brands are Made in

Mexico.

| OEM (Original Equipment Manufacturer) | Location(s) in Mexico | Notes |

|---|---|---|

| General Motors (GM) | San Luis Potosí, Coahuila, Estado de México | Produces models like Chevrolet Aveo and Trax. |

| Ford | Chihuahua, Sonora, Guanajuato | Known for producing trucks and small cars. |

| Nissan | Aguascalientes, Morelos | Operates two major plants, producing a range of vehicles. |

| Stellantis | Coahuila, State of Mexico | Produces a variety of models, including trucks and sedans. |

| Volkswagen | Puebla | Home to the production of models like Jetta and Tiguan. |

| Hyundai | Nuevo León | Hyundai and its affiliate Kia have significant investments in the region. |

| BMW | San Luis Potosí | Invested in a $1 billion facility for the 3 Series production. |

| Audi | Puebla | Focuses on the Q5 SUV. |

| Toyota | Baja California, Guanajuato | Tacoma production in Baja California; recently expanded in Guanajuato. |

| Kia | Nuevo León | Produces models like the Forte. |

| Mercedes-Benz | Aguascalientes (in collaboration with Nissan) | Produces luxury compact cars. |

| Tesla | Nuevo León (planned) | Announced plans for a new plant focusing on electric vehicles. |

Table 1: Automotive OEM Assembly Plants in Mexico

The Future of Automotive Manufacturing in Mexico

Looking ahead, Mexico's automotive industry is poised for further growth, especially with the increasing focus on electric vehicles (EVs). The United States-Mexico-Canada Agreement (USMCA) introduces new rules of origin, requiring that 75% of a vehicle's content be produced in North America, which is expected to boost regional manufacturing and supply chain integration further. Additionally, Mexico's comprehensive network of free trade agreements, competitive labor costs, and a well-established supplier base continue to attract investment from international automakers and suppliers alike .

Mexico's Auto Boom

Mexico's automotive industry is a dynamic and critical component of its national economy, offering vast opportunities for growth, innovation, and collaboration. As automakers and suppliers continue to explore the benefits of manufacturing in Mexico, the industry is set to drive forward, powered by a combination of strategic advantages that make it a global contender in automotive production. For companies like SIXM and others looking to expand or establish their manufacturing footprint, Mexico offers a compelling proposition characterized by cost efficiency, strategic location, and a skilled workforce ready to meet the demands of the future.

SIXM: Your Gateway to Manufacturing in Mexico

One of the key advantages of venturing into the Mexican manufacturing sector is the comprehensive support at your disposal. SIXM, with its deep-rooted experience, is adept at guiding automotive firms towards optimal growth paths. If you're aiming to broaden your international footprint with a strategic Mexican base, SIXM is your go-to partner for specialized support. Reach out to us today for a bespoke consultation.

Sources

The 26 automotive plants in Mexico.

United States-Mexico-Canada Agreement.