As businesses look to optimize their production processes and cut costs without sacrificing quality, Mexico has emerged as a highly attractive manufacturing destination. Its strategic location, skilled labor force, and favorable trade agreements make it an appealing choice for companies looking to expand or relocate their manufacturing operations. This blog delves into the costs associated with manufacturing in Mexico, offering a research-based perspective to businesses considering this move.

Strategic Location and Trade Agreements

Mexico’s proximity to the United States is a significant advantage, especially for North American companies. It reduces shipping times and costs, facilitating more efficient supply chain management. Moreover, Mexico is a part of various trade agreements, including the United States-Mexico-Canada Agreement (USMCA), which offers reduced tariffs and streamlined trade processes, contributing to cost savings.

Labor Costs

One of the most compelling reasons to manufacture in Mexico is the labor cost advantage. As of my last update in April 2023, Mexican manufacturing labor costs are significantly lower than those in the United States and Canada. However, they are slightly higher than in some Asian countries, though this is often offset by reduced shipping and logistics costs for North American markets

The average hourly wage for manufacturing workers in Mexico is approximately $2.30 to $4.50, depending on the industry and region. This is a fraction of the cost in the United States, where the average hourly wage for similar roles can be upwards of $20. This difference can lead to substantial savings on operational costs, making manufacturing in Mexico an attractive option for businesses aiming to maintain high-quality production while minimizing expenses. Here must read: How To Start A Manufacturing Business.

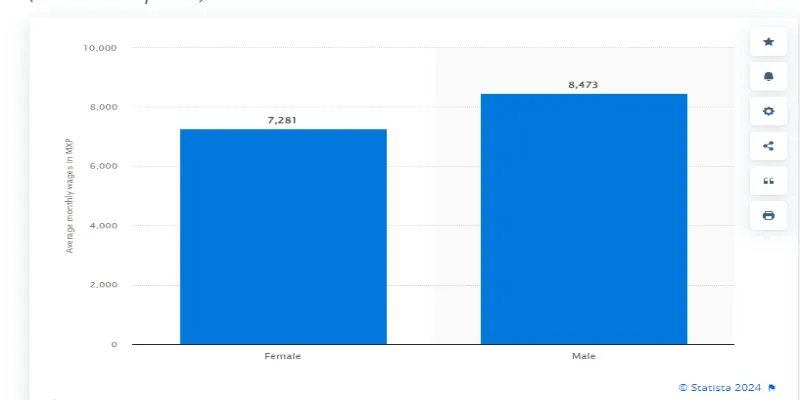

However, there is a gender wage gap in Mexico's labor market. In a survey in the third quarter of 2023 in Mexico, the average monthly wage for males stood at 8,473 Mexican Pesos, surpassing the average for females, which was 7,281 Mexican Pesos (Shown in Table 1). This discrepancy indicates that men earned approximately 16 percent more than their female counterparts, highlighting a significant gender wage gap in the country's earnings landscape.

Table 1: Average monthly wages in Mexico in 2023, by gender

Infrastructure and Operational Costs

Mexico has been investing heavily in its manufacturing infrastructure, including transportation networks, energy, and industrial parks, making it increasingly conducive to large-scale manufacturing operations. These developments, coupled with competitive utility costs—electricity and water—are further incentives for businesses. However, it's essential to consider the total operational costs, including shipping, logistics, and potential tariffs when importing raw materials or exporting finished products. These costs can vary greatly depending on the location within Mexico and the nature of the manufactured goods.

Regulatory Expenses Associated With Manufacturing

Establishing a manufacturing presence in Mexico involves several initial investments and considerations, particularly for companies choosing to independently incorporate. These initial expenses include incorporation fees and costs associated with various registrations necessary for operation. Additionally, navigating the import and export processes requires obtaining specific customs permits for both raw materials and finished goods, along with securing the appropriate operational permits.

An alternative approach to mitigate some of these startup costs involves partnering with a Shelter Company under the IMMEX (Manufacturing, Maquiladora, and Export Services Industry) program. This option provides the advantage of utilizing an existing framework with the required registrations and certifications already in place, potentially offering a smoother and more cost-efficient setup process.

For ongoing operational expenses, companies should anticipate a 16-percent value-added tax (VAT) on materials and equipment imported into Mexico. Nevertheless, this expense can often be bypassed for firms that register with the IMMEX program and secure an IVA (Value Added Tax) Certification. Beyond VAT, businesses must prepare for Mexico's corporate income tax, which stands at approximately 30 percent. There are also state payroll taxes that vary between 1.8 to 2.9 percent, alongside real estate taxes that range from 0.1 to 0.5 percent, all of which contribute to the ongoing fiscal responsibilities of operating within Mexico

Conclusion

Manufacturing in Mexico offers compelling cost advantages, from labor to logistics, for companies looking to enhance their production efficiency and bottom line. However, success in this endeavor requires a comprehensive understanding of the local manufacturing ecosystem, strategic planning, and careful management of operational costs. With the right approach, Mexico can be a pivotal location for businesses aiming to thrive in a competitive global market. While this analysis provides a snapshot of manufacturing costs in Mexico, it's crucial for businesses to conduct detailed, current research to inform their specific investment and operational strategies.

SIXM & Mexico: Pioneering Manufacturing Excellence

Mexico stands out as a compelling choice for companies aiming to optimize their manufacturing processes. For businesses like SIXM, venturing into this vibrant manufacturing ecosystem means not just achieving operational excellence but also embracing a future of innovation and growth. We invite you to contract manufacturing in Mexico, where the possibilities are as boundless as the horizon. Together, let's redefine the standards of manufacturing excellence with SIXM – where quality meets efficiency in every endeavor.

References

A quick guide to the IMMEX program in Mexico.

United States-Mexico-Canada Agreement.