Companies considering offshoring in Mexico to take leverage of the country's cheap labor costs must have a clear picture of the country's labor laws. Low costs aren't always indicative of unregulated circumstances. The Mexican Federal Labour Law specifies certain employee rights that guarantee your labor gets fair compensation, sufficient benefits, and a secure workplace.

The purpose of this blog post is to provide an abridged summary of some of the complex Mexico labor laws, in order to assist employers in identifying potential obligations.

Labor Law in Mexico

Mexico's Constitution and the Federal Labor Law, both specify the country's labor laws. Accordingly, a “job” or “working relation” is described as

“:…the rendering of a subordinated personal service to another person in exchange for a wage (Article 20 of the Labor Law)”.

The definition of a job is quite broad because, whatever the type of service provided, anyone who performs it for another person in exchange for payment is considered to be an employee and is therefore entitled to labor rights.

Mexican Labor Laws : The Legal Framework

The labor laws in Mexico stem from the Mexican Constitution, drafted in 1917, soon after the Mexican Revolution. Labor conditions and working environment were terrible back then. Therefore the Mexican labor laws are designed to protect the employee. Occasionally, to the point of being unjust to the corporations that employ them.

The Article 123 of Mexican Constitution reflects the finest efforts of the country's lawmakers in laying out the entire framework for labor relations. Mexico's legal hierarchy places the Constitution at the top.

So let's look at the most important components.

- Eight hours is the maximum length of a workday. Double pay is paid for overtime.

- Children under the age of 15 are not permitted to work.

- For every six days of labor, employees are entitled to one day of rest and relaxation.

- A minimum salary must exist.

- Mexican companies are required to provide their employees a portion of their profits.

- Strikes and unions are permitted.

- If a company ends the labor contract with an employee without cause, It must give the worker a severance payment equal to three months of the employee’s salary.

- Social Security is a guarantee for Mexican workers.

Mexico’s Federal Labor Law

The Federal Labor Law (“FLL”) of 1970 is the primary employment law in Mexico and applies to all employees rendering services in Mexico, regardless of the employee’s or employer’s nationality, where the salary is paid or where the agreement is executed.

The FLL establishes the minimum benefits to which employees are entitled, as well as employees’ and employers’ rights and obligations. This law also controls labor authorities and their obligations and sets forth the rules for labor litigation's procedural requirements.

A. Employment agreements

The FLL establishes different types of employment agreements:

1. Probationary and training periods

Employers are allowed to set up a probationary period to ensure that the employee satisfies the standards and has the skills necessary to execute the job in employment agreements for an indefinite length or that are anticipated to continue longer than 180 days. For most employees, the probationary period lasts up to 30 days, although it may be extended to 180 days for those in managerial, technical, or professional roles.

2. Initial training period

The employment agreement can typically be set up for a length of up to three months for roles requiring initial training or up to 180 days for managerial, technical, or professional positions.

3. Indefinite Period

According to the "employment stability" principle, a contract is presumed to be for an unlimited time (i.e., open-ended) unless it specifically states otherwise.

4. Fixed Term

A fixed-term contract is only enforceable if:

- A defined period is needed by the nature of the work; or

- For a temporary replacement of an absent employee.

5. Specific-task

A contract to perform a specific task or project is actionable only if it is needed for carrying out the work.

The employment connection will continue for the duration of the unfinished job if, at the end date of a fixed-term or specific-task contract, the work has not been finished.

B. Employee Rights

1. Work Shift and Overtime

The statutory working hours in Mexico are:

- Eight hours for day work - defined as work between 6am and 8pm;

- Seven hours for night work - defined as work between 8pm and 6am; and

- Seven and a half hours for "mixed" work - defined as a shift that includes both day and night work.

- As a six-day working week is the norm, the legislation implies that working weeks have a maximum of 48 hours for day work, 42 hours for night work, and 45 hours for mixed work.

- An employee can work up to three hours of overtime per day for up to nine hours per week at double the standard hourly rate. Employees who put in more than nine hours of overtime must receive three times their regular hourly wage as compensation.

- The law prohibits overtime work for anyone under the age of 16, and pregnant or nursing mothers if it endangers the worker's or the child's life.

Must Read: Manufacturing in Mexico vs China - Which is better?

2. Work Minimum Wage

In Mexico, there is no set national minimum wage. Rates are annually determined by the National Minimum Wage Commission considering geographic areas. Mexico City and the region north of the capital, up to the US border, fall under Area A, whereas the rest of the country is covered by Area B. In order to compensate for differences in regional economies, minimum wage rates are established individually for various regions.

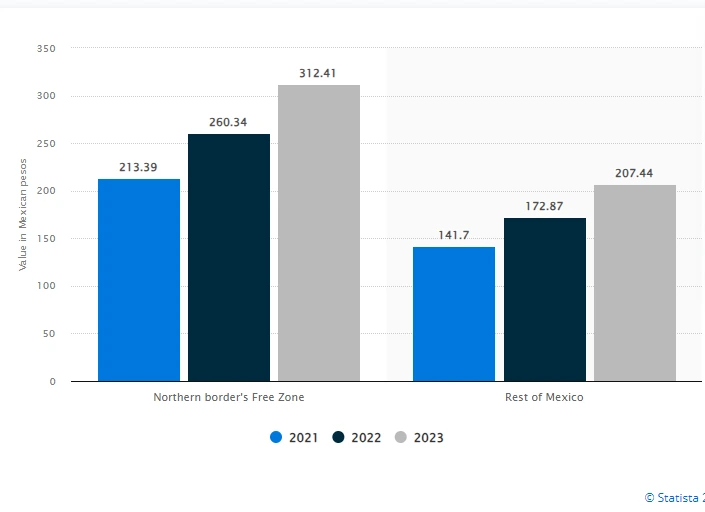

It was decided that the legally mandated minimum wage in Mexico would rise by around 20% between 2022 and 2023, reaching 207.44 Mexican pesos in 2023. The exception was the Free Zone, along the northern border, where the minimum daily salary rose to 312.41 Mexican pesos.

Minimum daily wage in Mexico from 2021 to 2023 (in Mexican pesos) is shown in table:

Table1: Minimum daily wage in Mexico from 2021 to 2023

3. Minimum Benefits

-

Profit Sharing

Employees have rights to a 10% pre-tax share of the company's earnings, with certain exceptions for newly started companies in their first year and the highest-ranking officer.

-

Paid Vacation

Seniority-based vacation days range from 6 to 14 days, and after the fifth year of service, they increase by two days every five years.

-

Mandatory Holidays

Holidays that must be celebrated include Christmas, New Year's Day, Labour Day, Benito Juarez Day, Independence Day, and December 1 (in election years).

-

Vacation Premium

Employees receive an extra 25% of their regular wage during their vacation.

-

Christmas Bonus

By December 20 of each year, employers are required to give each employee the equivalent of 15 days' pay.

-

Social Security System

All employees must be registered with and contribute to, Mexican Institute of Social Security (“IMSS”), National Workers’ Housing Fund Institute (“INFONAVIT”), and Retirement Savings Program (“SAR”), for health care, housing assistance, and retirement benefits.

-

Parenthood Rights

Paternity Leave: 5 days at full pay for the birth or adoption of a child.

Maternity Leave: 6 weeks before and after childbirth, with options for leave transfer. Extended leave for children with disabilities.

Lactation Rest Period: Up to two 30-minute paid breaks or a one-hour reduction in the work shift during the first 6 months after childbirth.

4. Holiday and Holiday Pay

Employees cannot be forced to work on mandatory holidays, and those who do are entitled to three times their normal pay. Agreements on working hours are required, with dispute resolution by the Conciliation and Arbitration Board.

5. Time Off from Work

A rest interval of at least 30 minutes during a full workday, which, if the employee is unable to leave the office, is included in the calculation of the workday.

Must Read: Business Culture Of Mexico - Know Every Important Detail

C. Legal Termination of Employment

Termination Grounds and Methods

Employment agreements can be terminated by mutual agreement, death of the employee, physical or mental incapacity, or disability. Contracts may end for cause, at the completion of a fixed-term, or upon completion of a specific task or project.

Severance Payment and Benefits

If terminated without just cause, employees are entitled to severance payment, including three months' full pay, 20 days' pay per year of service, and a "seniority bonus." Payment also covers accrued unpaid wages and benefits up to the termination date.

Termination for Cause by Employer

Just causes for employer termination include dishonesty, violence, harassment, property damage, safety negligence, and more. Dismissing an employee for just cause requires written notification to the employee or the Conciliation and Arbitration Board, with failure to notify making the dismissal unjustified.

Termination for Cause by Employee

Employees can terminate the contract for just cause if misled about job conditions, faced with dishonesty, violence, pay reduction, non-payment, or safety hazards. The employee is entitled to a statutory seniority bonus and severance payment equivalent to a dismissal without just cause, but reinstatement is not an option.

Current State of Labor Laws in Mexico

Mexico's labor laws have seen substantial changes in recent years. New standards established by the USMCA, the trade pact that replaced NAFTA for Mexico, Canada, and the United States, led to changes in some of these statutes. Must explore how NAFTA affected the manufacturing sector in Mexico.

To address discrimination and unfair labor practices in the workplace, Mexico passed new regulations in 2019. According to these regulations, companies that employ people in Mexico are required to cooperate with their staff members to develop internal procedures that will aid in preventing problems such as child labour.

Many of the changes to Mexican labor legislation have made things simpler for business owners. For instance, instead of being subject to routine compliance inspections, many businesses can now self-report their compliance through a government website, which then notifies them of any violations and gives them deadlines for taking corrective action. Employers who self-report in this manner and are deemed to be in conformity receive certificates confirming their good status; however, self-reporting is voluntary.

Employers must be careful that they do not abuse their convenience by self-reporting false information, which may result in additional inspections, fees, legal repercussions, and other issues.

Final Thoughts

Understanding Mexico's labor laws is crucial for both employers and employees to ensure fair and legal practices in the workplace. Staying informed not only protects the rights of employees but also contributes to the overall well-being of the labor market.

Get a Consultation

To avail the ease of sourcing products from Mexico while fostering a progressing and equitable work culture you can contact our experienced sourcing professionals and manufacturing consultants at SIXM. SIXM will assist you to build a successful brand in mexico.

Sources:

- Federal Labor Law (“FLL”) of 1970 - http://www.apsi.com.mx/Downloads01Apsi/Basics_of_Mexican_Labor_Law.pdf

- NAFTA on labor cooperation between the Government of Mexico, Canada, and the United States - http://www.sice.oas.org/trade/nafta/labor-c1.asp

- Minimum daily wage in Mexico from 2021 to 2023 - https://www.statista.com/statistics/1280031/evolution-minimum-wage-day-mexico