As global supply chains face rising costs, shipping delays, and mounting uncertainty, more furniture brands are re-evaluating their sourcing strategies, and increasingly, their attention is turning to Mexico. With its skilled workforce, strong trade ties to the U.S. and Canada, and growing manufacturing infrastructure, Mexico is quickly positioning itself as a top-tier alternative to Asia for furniture production.

From reduced lead times and lower logistics costs to easier communication and improved quality control, sourcing from Mexico offers real, measurable advantages. For companies seeking to simplify operations without compromising on quality or speed, the shift isn’t just logical, it’s strategic.

In this article, we break down the key reasons why global furniture brands are moving production to Mexico and how your business can benefit from doing the same.

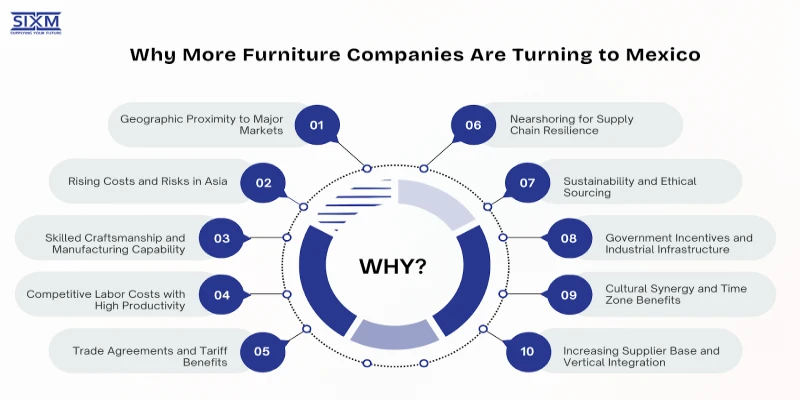

Why More Furniture Companies Are Turning to Mexico

Mexico is quickly becoming a preferred sourcing destination for global furniture brands. Here are some of the key reasons why furniture companies are increasingly choosing Mexico as a sourcing and manufacturing base:

1. Geographic Proximity to Major Markets

One of the biggest advantages of sourcing from Mexico is its proximity to the United States and Canada. For North American brands, shorter shipping distances mean:

- Reduced lead times: What takes 30-45 days from Asia by sea may take just 3-7 days by truck or rail from Mexico.

- Lower transportation costs: Savings on freight and duties add up, especially with container rates fluctuating.

- More flexibility in inventory management: Brands can move to just-in-time (JIT) manufacturing or near real-time replenishment.

As e-commerce continues to demand quicker delivery and better inventory control, these proximity benefits are more relevant than ever.

2. Rising Costs and Risks in Asia

While Asia has long been the world’s furniture manufacturing powerhouse, several challenges are pushing brands to reconsider:

- Labor costs are rising: China’s labor costs have nearly tripled over the past decade. Even in Vietnam and Indonesia, wages are climbing.

- Tariffs and trade tensions: The U.S.-China trade war and ongoing geopolitical instability have made sourcing from China less predictable.

- Port congestion and shipping disruptions: Events like the COVID-19 pandemic and the Suez Canal blockage revealed how vulnerable long supply chains can be.

Mexico offers an alternative with fewer political risks and cost pressures—without sacrificing product quality.

3. Skilled Craftsmanship and Manufacturing Capability

Mexico has a long tradition of woodworking and craftsmanship, particularly in regions like Jalisco, Puebla, and Chihuahua. Many local manufacturers specialize in:

- Solid wood furniture

- Rustic and colonial styles

- Metal and leather furniture

- Upholstered seating and sofas

Additionally, Mexican manufacturers are increasingly adopting modern manufacturing processes, including CNC machining, laser cutting, and ERP systems. This mix of old-world craftsmanship and new-world technology allows furniture brands to create high-quality, scalable products.

4. Competitive Labor Costs with High Productivity

While wages in Mexico are higher than in some Southeast Asian countries, productivity per worker is often better. This is due to:

- Stronger work culture alignment with Western expectations

- Ease of communication in English or bilingual Spanish-English operations

- More accessible worker protections and labor laws than in many Asian nations

These factors contribute to fewer production errors, better communication, and a smoother experience for sourcing and production teams.

5. Trade Agreements and Tariff Benefits

Mexico is part of several trade agreements that make sourcing more cost-effective:

- USMCA (United States-Mexico-Canada Agreement): llows tariff-free exports of furniture between member countries if origin requirements are met.

- CPTPP (Comprehensive and Progressive Agreement for Trans-Pacific Partnership): Opens access to Pacific Rim markets.

- EU-Mexico Trade Agreement: Enables access to European markets under favorable trade terms.

This web of agreements gives Mexican suppliers and international buyers a major advantage in reducing duties and expanding export markets.

6. Nearshoring for Supply Chain Resilience

The COVID-19 pandemic fundamentally reshaped how companies view risk. With factory shutdowns, container shortages, and delayed shipments wreaking havoc on supply chains, brands began shifting from globalization to regionalization.

Nearshoring to Mexico helps brands:

- Avoid global supply chain bottlenecks

- Reduce dependence on single-source suppliers (like China)

- Increase agility in responding to demand fluctuations

In 2023–2025, “China+1” sourcing strategies became “China+Mexico” for many brands seeking resilience without sacrificing competitiveness.

7. Sustainability and Ethical Sourcing

Consumers are demanding more transparency and accountability in how and where products are made. Sourcing from Mexico supports:

- Lower carbon footprints: Thanks to shorter transport distances.

- Better oversight: Brands can more easily conduct factory audits and implement sustainability programs.

- Certifications: Many Mexican manufacturers comply with FSC (Forest Stewardship Council) and other eco-certification standards.

The ability to source high-quality furniture with sustainable materials and ethical labor practices is a growing differentiator.

8. Government Incentives and Industrial Infrastructure

Mexico has invested heavily in developing its industrial capabilities. Key benefits include:

- Industrial clusters: Furniture production hubs like Guadalajara and Monterrey offer integrated supply chains.

- Free trade zones and maquiladoras: These special manufacturing zones provide tax and customs benefits to exporters.

- Government support: Federal and local governments often assist foreign buyers in locating reliable suppliers and navigating regulations.

This level of infrastructure and institutional support reduces sourcing friction and helps brands scale operations smoothly.

9. Cultural Synergy and Time Zone Benefits

Working with suppliers in Mexico allows for:

- Real-time collaboration: Similar time zones to the U.S. allow same-day communication.

- Easier travel: For design approvals, quality checks, and factory visits.

- Shared business culture: U.S. and Mexican business practices often align better than U.S.-Asia business relations, reducing friction.

This makes Mexico a strong fit for mid-sized companies and startups that value direct involvement in their sourcing process.

10. Increasing Supplier Base and Vertical Integration

Mexico’s furniture export sector has been growing, and with it, so has the supplier ecosystem. Many manufacturers now offer:

- Vertical integration: From raw wood processing to upholstery, packaging, and shipping.

- Private label and OEM services: Allowing retailers and designers to quickly scale production under their own brand.

- Custom design and prototyping: A significant advantage for boutique furniture lines and DTC brands.

This evolution of manufacturing capability has made Mexico an ideal partner—not just a backup plan.

Case Studies: Brands That Are Benefiting

Several global and mid-sized brands have successfully shifted part of their supply chain to Mexico, gaining advantages in speed, cost-efficiency, and greater control over production quality.

Case 1: West Elm

West Elm, a brand focused on mid-century and modern aesthetics, has partnered with artisan workshops in Mexico to create handcrafted, fair-trade certified collections.

Case 2: Four Hands

The Texas-based brand has expanded its sourcing footprint in Mexico to support faster product development and reduce shipping delays, especially post-pandemic.

Case 3: Startup Brands

Many emerging e-commerce furniture brands like Burrow, Article, and Floyd are exploring Mexican sourcing to reduce overheads and align with sustainable practices.

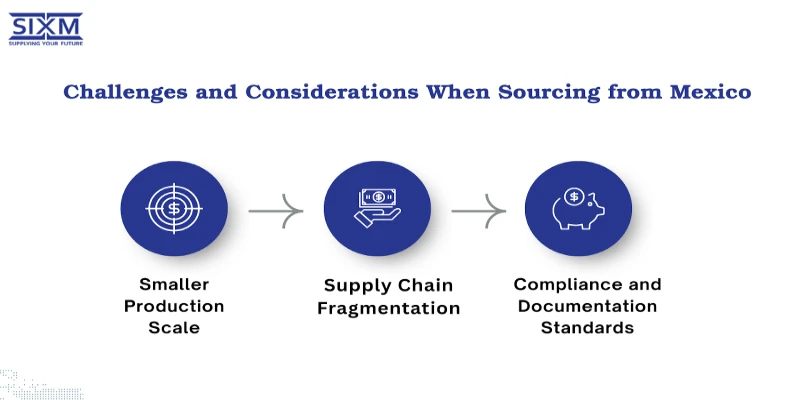

Challenges and Considerations When Sourcing from Mexico

While Mexico offers compelling advantages as a nearshoring destination, such as proximity to the U.S., trade agreements, and lower shipping times, it’s important to approach supplier selection and production planning with a realistic understanding of the region’s limitations. Below are key challenges and considerations to keep in mind:

1. Smaller Production Scale

Unlike the megafactories found in countries like China or Vietnam, many manufacturers in Mexico, especially in the furniture sector, operate on a smaller, workshop-style scale. This means that while the craftsmanship and quality may be high, not all suppliers are equipped to handle large-scale or highly automated production runs. Brands that require mass production may need to work with multiple suppliers or invest time in identifying the few high-capacity manufacturers available. This is particularly important for fast-growing businesses or those with seasonal demand spikes.

2. Supply Chain Fragmentation

In certain regions of Mexico, the supply chain can be fragmented. This includes inconsistent access to raw materials, components, or skilled labor depending on the location. For example, while Guadalajara and Monterrey have strong, integrated manufacturing ecosystems, smaller or emerging hubs like Puebla or Aguascalientes may still face challenges in sourcing high-quality inputs locally. This can lead to longer lead times, higher internal logistics costs, or the need to import materials from other parts of Mexico or even abroad. Businesses must conduct thorough supply chain assessments when selecting their manufacturing partners.

3. Compliance and Documentation Standards

Not all Mexican suppliers are equally familiar with international compliance requirements, particularly those mandated by U.S., Canadian, or EU regulations. Depending on the sector, manufacturers may need to comply with certifications such as FSC for sustainable wood, CARB Phase 2 for formaldehyde emissions, ISO standards, or various labeling and safety protocols. While many of the more established exporters are already aligned with these standards, newer or smaller suppliers may require additional guidance or third-party verification. Ensuring clear documentation and regulatory alignment from the outset is crucial to avoid shipment delays or customs issues.

4. The Outlook Is Improving

Despite these challenges, Mexico’s manufacturing sector is evolving rapidly. Increased foreign investment, government support, and demand from U.S.-based companies are driving improvements in scale, quality systems, and regulatory understanding. Industrial clusters are becoming more sophisticated, and more suppliers are adopting digital tools, quality audits, and global best practices to meet international standards.

By approaching supplier sourcing with proper vetting, clear communication, and realistic expectations, businesses can effectively navigate these challenges and fully leverage the benefits of manufacturing in Mexico.

Key Cities of Furniture Manufacturing in Mexico

Mexico’s furniture industry is concentrated in several key cities, each offering unique strengths in materials, craftsmanship, and export capabilities.

1. Guadalajara (Jalisco)

Often referred to as the furniture capital of Mexico, Guadalajara is the country’s largest and most developed hub for furniture manufacturing. The city boasts a rich tradition of craftsmanship paired with modern industrial capabilities, making it a go-to source for high-quality home and office furniture. It specializes in upholstered furniture, bedroom sets, dining room pieces, and wood-metal blends. Guadalajara is also home to Expo Mueble, Latin America’s largest furniture trade show, attracting global buyers and suppliers every year. With its strong transportation links and proximity to key ports, Guadalajara is well positioned to serve both domestic and international markets, especially the United States.

2. Monterrey (Nuevo León)

Monterrey is one of Mexico’s most advanced industrial cities and plays a major role in commercial and contract furniture production. Known for its modern factories and efficient logistics, Monterrey excels in producing office furniture, metal-based furnishings, and commercial seating solutions. Its proximity to the U.S. border makes it a strategic location for exporting large volumes of goods with reduced shipping times. Companies here often operate with a high degree of automation and quality control, making Monterrey a popular choice for businesses seeking scalability and consistent output in their furniture supply chain.

3. Tijuana (Baja California)

Tijuana stands out as a vital location for nearshoring, especially for U.S.-based furniture brands. Just across the border from California, Tijuana offers quick access to the U.S. market and is home to a growing cluster of factories producing flat-pack furniture, mattresses, modular seating, and custom contract pieces. The city’s integration with American logistics networks gives it a competitive advantage in terms of lead time and shipping efficiency. Many international furniture companies have established manufacturing operations in Tijuana to leverage its bilingual workforce, lower labor costs, and strong export infrastructure.

4. Puebla

Puebla combines a rich tradition of craftsmanship with a steadily growing industrial base. It is known for its carved wood furniture, traditional styles, and high-end artisanal finishes that reflect Mexico’s cultural heritage. While not as mechanized as other regions, Puebla’s furniture industry caters to both domestic consumers and international buyers looking for unique, handcrafted pieces. With improving infrastructure and its central location near Mexico City, Puebla is emerging as a niche destination for buyers seeking premium-quality, culturally distinct furniture products.

5. Aguascalientes

Aguascalientes is a rising player in Mexico’s furniture manufacturing sector. Although not as large as Guadalajara or Monterrey, this centrally located city is attracting increasing foreign investment thanks to its skilled labor force, low operational costs, and growing industrial parks. Manufacturers here primarily produce residential wooden furniture and mixed-material designs for mid-market and export-oriented brands. Its strategic location allows for efficient distribution to major cities like Mexico City and Guadalajara, making it a practical option for businesses looking to diversify their sourcing base.

Want to see how Mexico stacks up against other leading sourcing destinations? Explore our in-depth guide on the Top Countries for Global Sourcing in 2025 to find the best fit for your business.

Future Outlook: A Long-Term Strategic Shift

The trend of sourcing furniture from Mexico isn’t a temporary adjustment; it reflects a broader strategic shift in global trade. As the world moves toward regionalization, resilience, and sustainability, Mexico’s role in global furniture supply chains is only set to grow.

According to the Mexican Furniture Manufacturers Association (AFAMJAL), exports are expected to grow at over 12% annually through 2027. This growth is driven not only by U.S. brands but also by companies in Europe and South America looking for a closer, reliable production base.

Deciding between sourcing locally or internationally? Our guide on Local Sourcing vs Global Sourcing breaks down the pros and cons to help you make the right choice.

Sourcing Furniture from Mexico? SIXM Makes It Easy

Sourcing from Mexico presents a powerful opportunity for furniture brands seeking a balance between quality, cost, speed, and sustainability. For companies launching new product lines or looking to diversify their supply chains, Mexico offers strategic advantages that are hard to ignore.

From artisanal wood furniture to modern upholstered designs, Mexico is more than just a nearshoring option; it is becoming a key partner in the future of global furniture manufacturing.

At SIXM, we specialize in helping brands navigate the sourcing landscape in Mexico through our Strategic Sourcing Services, connecting you with reliable manufacturers, managing quality control, and streamlining the onboarding process. Ready to strengthen your supply chain and scale with confidence? Partner with SIXM and take the next step toward smarter, more strategic sourcing.