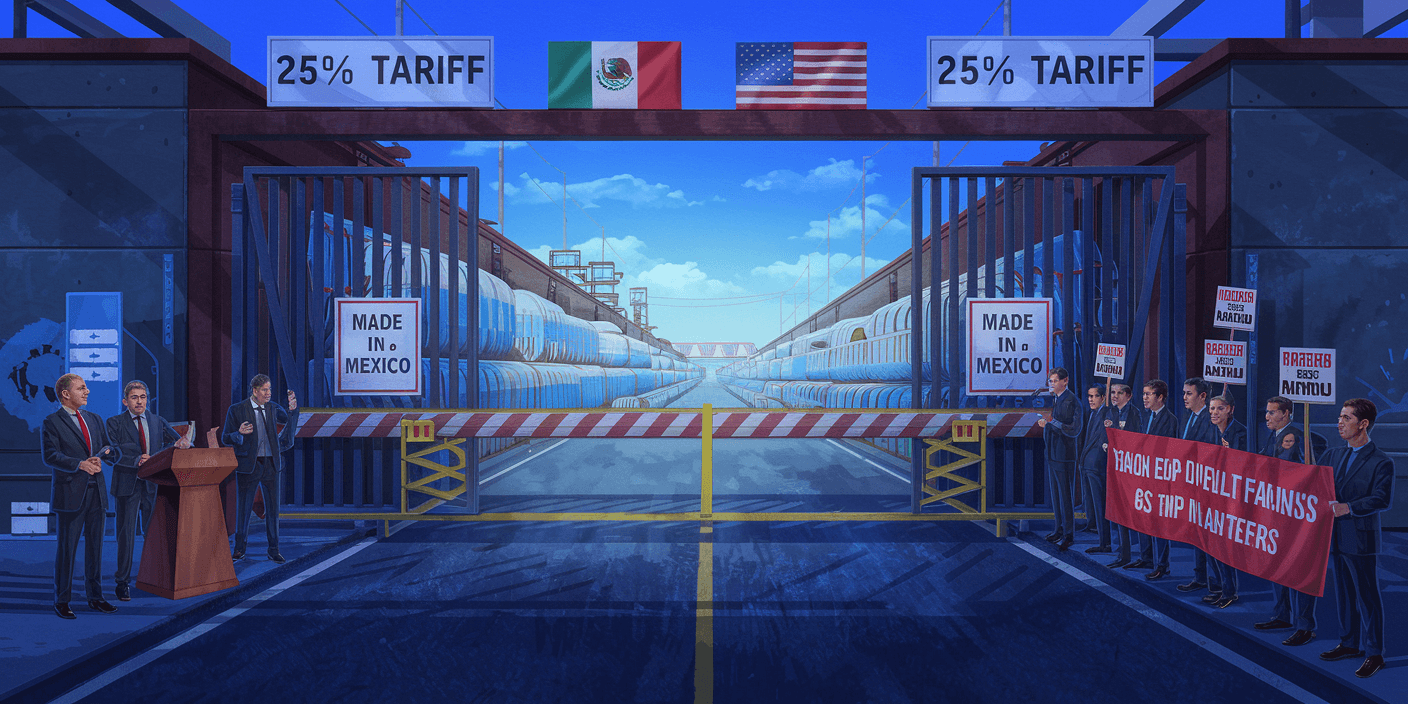

On November 25, 2024, President-elect Donald Trump gave his plan to impose substantial tariffs on imports from Mexico, China, and Canada. The proposal includes a 25% tariff on goods imported from Mexico and Canada, and a 10% tariff on Chinese products. Trump has made it clear that these tariffs will be among his first executive orders, which he aims to sign on January 20, 2025, the day of his inauguration.

The purpose of these tariffs, as outlined by Trump on social media, is to pressure these countries to take action on issues like illegal immigration and the flow of illicit drugs into the United States. This move has already sparked responses from key leaders, with Mexico’s President Claudia Sheinbaum and Canada’s Prime Minister Justin Trudeau actively seeking to prevent these tariffs from taking effect on their exports.

In this article, we analyze whether these proposed tariffs are enforceable, how they might affect Mexico’s manufacturing and exports, and what businesses can do to manage the uncertainty.

Is the U.S. Legally Allowed to Impose Tariffs on Mexico?

Under the United States-Mexico-Canada Agreement (USMCA), which replaced the North American Free Trade Agreement (NAFTA), the three countries are bound to maintain tariff-free trade on most products, including agricultural goods. Trump's proposed 25% tariff on Mexican imports would directly contradict this agreement, which prohibits the imposition of new tariffs outside the conditions agreed upon in the deal.

However, the USMCA includes a clause that could allow tariffs to be imposed for "essential security" reasons, which would give the U.S. government the legal grounds to impose tariffs on Mexican goods. The United States has used this justification in the past, particularly for national security concerns. Additionally, U.S. trade laws provide the president with the authority to impose tariffs during national emergencies or in response to unfair trade practices. These legal avenues could be used to justify the tariff plan, but such a move is likely to provoke legal challenges.

Mexico and Canada could dispute these tariffs through the USMCA's dispute resolution mechanism. Given that the agreement prohibits the imposition of tariffs unless there is a clear legal basis, Mexico could challenge the tariffs as violations of the terms of the deal.

USMCA Review in 2026: A Turning Point?

The USMCA includes a clause requiring a review of the agreement every six years, with the next review set for 2026. This provides an opportunity to renegotiate certain terms of the trade deal, including tariff rates. Even if Trump does not implement the proposed tariffs immediately, the 2026 review could serve as a pivotal moment where tariff rates are reconsidered.

Considering the vital role of cross-border trade in U.S. border states such as Texas and California, it is doubtful that the USMCA will be completely discarded. These states have a long history of benefiting from free trade with Mexico, and imposing tariffs could significantly disrupt their economies. Therefore, while some tariff changes are likely, it’s improbable that the USMCA will be fully abandoned.

Potential Economic Impact of Trump’s Tariffs

If Trump’s tariff plan is implemented, U.S. businesses and consumers are likely to face higher costs. For instance, products like avocados, which Mexico exports in large quantities to the U.S., could become more expensive. Given the close trade ties between Mexico and the U.S., particularly in sectors like agriculture and manufacturing, the proposed tariffs could also increase production costs for American companies relying on Mexican imports.

However, it is our assessment that even if Trump moves forward with his tariff proposal in 2025, it will face significant hurdles due to legal challenges related to the USMCA. These challenges are likely to delay or prevent the tariffs from taking effect until 2026, when the USMCA will be reviewed. At that point, there may be greater flexibility for the U.S. to impose new tariffs or renegotiate existing rates.

Future Tariff Outlook: Expected Negotiations and Adjustments

Canada and Mexico have already taken steps to address U.S. concerns, such as Mexico’s recent seizure of a record quantity of fentanyl pills, signaling its commitment to combating illegal drug trafficking. These actions could play a role in softening the U.S. position, potentially leading to more targeted tariff increases rather than sweeping, economy-wide measures.

How Can Businesses Prepare for Potential Tariffs?

The uncertainty surrounding these proposed tariffs poses challenges for businesses involved in cross-border trade with Mexico. Here are a few strategies to mitigate potential risks:

Conduct a Comprehensive Cost Analysis

Assess whether the recent decline in the Mexican peso could still offer financial advantages, even if tariffs are imposed. This analysis will help determine whether maintaining operations in Mexico remains beneficial.Review Supply Chain and Logistics

Businesses should work with their Mexican logistics partners, customs brokers, and contract manufacturers to explore duty-free mechanisms such as IMMEX, which can help offset the financial impact of tariffs.Utilize Mexico’s Free Trade Zones

Mexico has established free trade zones that provide tax and duty exemptions to foreign companies. These zones can be a strategic way to mitigate tariff impacts, so businesses should explore these options as part of their long-term planning.Diversify Supply Chains

Companies should consider diversifying their supply chains to reduce reliance on any single country. Having alternative suppliers in other countries may help alleviate the risk posed by potential tariffs on Mexican goods. Must see: Top Reasons Organizations Should Embrace Strategic Sourcing

The ongoing uncertainty surrounding tariff negotiations underscores the importance of staying agile and informed. By exploring all available options and being proactive in their planning, businesses can position themselves to navigate the evolving trade landscape with greater confidence.

Streamline Sourcing and Manufacturing with SIXM

At SIXM, we are committed to supporting businesses through these uncertain times. We provide comprehensive solutions in supplier management, quality control, technical recruitment, and manufacturing excellence. For businesses looking to optimize their supply chain, explore our Mexico Sourcing & Procurement Services. Let us help you handle these changes and achieve sourcing and manufacturing success with your vendors. Contact us today to learn how we can support your business through these challenges and beyond.