Global supply chains are shifting fast. Tariffs, geopolitical changes, labor costs, and transit times are forcing businesses to rethink where they source products. In 2025, China, India, and Mexico stand out as the three most viable sourcing hubs but each offers a different mix of cost, speed, and risk.

This guide explores cost structures, lead times, trade agreements, risks, and product fit to help you identify the best country for your supply chain strategy.

Fast Facts: China vs India vs Mexico, 2025

A quick comparison of China, India, and Mexico in 2025 reveals how each performs in cost, speed, trade benefits, and manufacturing capacity.

| Factor | China | India | Mexico |

|---|---|---|---|

| Transit Time to the U.S. | 22–35 days by sea | 28–40+ days by sea | 2–5 days by truck/rail |

| U.S. Duty Status | Section 301 tariffs (risk) | MFN duties (no FTA) | Duty-free under USMCA (if qualified) |

| Labor Cost | Moderate, rising | Lowest of the three | Low–mid, rising |

| Manufacturing Ecosystem | Most mature, high-tech | Rapidly growing, diverse | Strong in autos, electronics, heavy goods |

| Best For | Complex, high-volume products | Cost-sensitive SKUs | Short lead-time, bulky goods |

Cost Drivers That Matter in 2025

Multiple elements influence sourcing costs, with tariffs and trade agreements playing a major role alongside logistics, labor, and production efficiency.

Tariffs & Trade Agreements

China continues to face Section 301 tariffs on many categories of goods. In recent years, additional tariff hikes on products such as solar panels, electric vehicles, and electronics parts have made cost planning more unpredictable for importers.

India does not currently have a free trade agreement with the United States. As a result, standard Most Favored Nation (MFN) rates apply to most imports, although discussions about potential trade deals are still ongoing.

Mexico benefits from the USMCA, which allows qualifying goods to enter the U.S. duty-free if they meet the rules of origin. This advantage is particularly valuable for industries such as automotive manufacturing and electronics assembly.

Freight & Lead Times

Shipping goods from China to the United States typically takes between three to five weeks by sea. Air freight offers a faster option, averaging two to five days, though at a significantly higher cost.

India’s ocean freight times are similar to China’s, though shipments to the U.S. East Coast can be slightly longer. Air freight timelines are also comparable, but logistics infrastructure improvements are gradually increasing efficiency.

Mexico offers a clear advantage in lead times, with cross-border freight measured in days rather than weeks. This proximity allows for greater flexibility, faster replenishment, and more agile supply chain management compared to overseas sourcing.

Labor Costs

India maintains the lowest labor rates among the three countries, supported by a large and growing pool of skilled and semi-skilled workers. This makes it attractive for labor-intensive manufacturing.

Mexico’s wages have been increasing in recent years, but the country remains cost-effective compared to U.S. labor costs. Proximity to the U.S. also reduces other expenses, such as shipping and inventory holding costs.

China’s labor costs are higher than those in India and Mexico, but the country’s extensive manufacturing infrastructure, large-scale production capabilities, and high worker productivity often balance out the higher wages.

Risk & Compliance Considerations

Risk and compliance factors can directly impact costs, timelines, and supplier reliability, making them key considerations in any sourcing decision.

China

China still deals with unpredictable tariffs because of trade tensions with the United States. These changes can quickly affect product prices and make supply chain planning harder. Importers also have to follow strict U.S. rules against forced labor. This means they must be able to prove exactly where their materials come from and show that no part of the supply chain uses unethical labor practices.

India

India’s manufacturing sector is growing, but some infrastructure issues remain. Common challenges include busy ports, transport routes that are not fully connected, and limited storage facilities in some areas. The government is working to improve things through national logistics programs, which are gradually making shipping and delivery faster and more reliable.

Mexico

Mexico’s close location to the U.S. makes shipping faster and cheaper than from overseas. However, busy border crossings can still cause delays. To ship products duty-free under the USMCA trade agreement, companies must meet strict rules about where materials come from. This requires accurate paperwork and close coordination with suppliers.

Which Country Fits Your Product Category?

Choosing the right sourcing destination depends on your product’s size, complexity, demand patterns, and cost priorities

| Product Category | Best-Fit Country | Why It Fits |

|---|---|---|

| Time-sensitive goods (seasonal apparel, promotional items, perishable packaging) | Mexico | Short 2–5 day shipping to the U.S., faster replenishment, reduces stockout risk. |

| Bulky or heavy products (furniture, appliances, automotive parts) | Mexico | Lower shipping costs than ocean freight from Asia, plus duty-free under USMCA if qualified. |

| Labor-intensive products (textiles, garments, footwear) | India | Lowest labor rates, large skilled workforce, competitive manufacturing costs. |

| Basic electronics (small appliances, simple devices) | India | Cost-efficient for simpler production; growing electronics manufacturing ecosystem. |

| Simple mechanical/plastic assemblies | India | Cost advantage for stable-demand, lower-complexity products. |

| High-volume consumer electronics (smartphones, laptops, wearables) | China | Advanced supply chains, consistent quality, and large-scale manufacturing capabilities. |

| Precision equipment & specialized components (optics, semiconductors, medical devices) | China | Specialized expertise, established vendor networks, and quality control maturity. |

| Complex multi-part assemblies (industrial machinery, EV systems) | China | Dense manufacturing clusters and integrated supply chains enable efficiency and precision. |

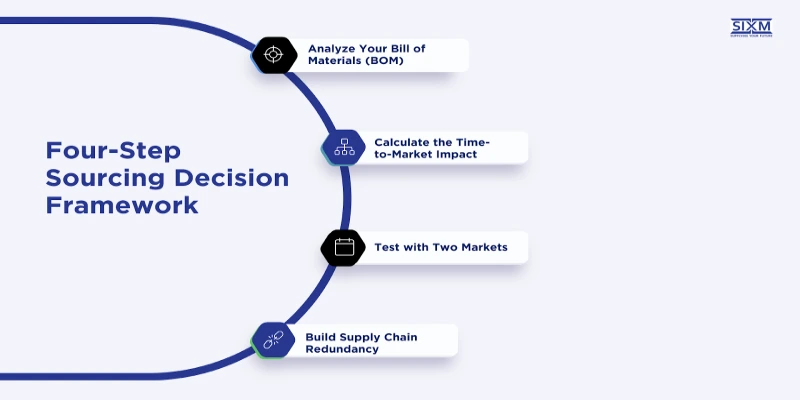

A Four-Step Sourcing Decision Framework

To choose the right sourcing location and minimize risk, follow these four practical steps that balance cost, speed, and reliability.

- Analyze Your Bill of Materials (BOM) Review each item in your BOM and match its HS code to applicable tariff rates and trade agreements. This will help you understand duty costs and identify opportunities for savings.

- Calculate the Time-to-Market Impact Consider both shipping lead times and the cost of holding inventory. Faster delivery may reduce stockouts and free up working capital, while slower routes may require higher inventory levels.

- Test with Two Markets Run small-scale production trials in two different countries. Compare results for product quality, production efficiency, and on-time delivery to determine the stronger sourcing option.

- Build Supply Chain Redundancy Always maintain at least one qualified alternative supplier in a different region. This protects your operations against disruptions such as political instability, natural disasters, or sudden cost increases.

Landed Cost Scenarios for 2025 Sourcing Decisions

The real cost of sourcing goes beyond factory prices alone. It includes tariffs, freight, and delivery times that can shift overall profitability. Here’s a snapshot of how each country’s cost structure and logistics impact sourcing decisions.

Mexico – USMCA Qualified

If your products qualify under the USMCA rules of origin, they can enter the United States duty-free. Combined with Mexico’s short lead times, often just a few days by truck or rail, this can dramatically reduce inventory costs and improve cash flow. Although manufacturing costs may be higher than in India, savings on freight, duties, and storage often make Mexico the more cost-effective option for time-sensitive goods or high-volume shipments such as furniture, appliances, and automotive parts.

India

India offers some of the lowest labor costs globally, making it an attractive choice for labor-intensive manufacturing. Lead times are typically four to six weeks by sea, which means companies must plan further in advance. India is highly competitive for products with predictable demand, such as textiles, garments, and basic electronics. While longer transit times require holding more inventory, the savings at the production stage can be substantial.

China

China continues to be the global leader for complex, large-scale manufacturing. Its extensive supplier networks, advanced technical expertise, and world-class infrastructure allow the production of everything from precision electronics to heavy machinery with consistent quality. However, U.S. tariffs such as Section 301 duties can raise overall costs. Companies sourcing from China should account for these tariffs in their pricing strategies or explore options such as partial assembly in other countries to reduce their impact.

For more insights on leading procurement hubs, read our blog on Top Countries for Global Sourcing in 2025 | Best Sourcing Destinations.

Country Snapshots: Strengths and Risks for 2025 Sourcing

China

Strengths China is still the world’s most developed manufacturing hub, with deep supplier networks, advanced technology, and consistent quality control. It’s the leading choice for products that require complex assembly, high precision, or large production volumes.

Risks The main risks are tariff exposure and geopolitical uncertainty, particularly in the U.S.–China relations. Changes in trade policy can quickly affect pricing. Compliance is also a growing challenge, with strict regulations like the Uyghur Forced Labor Prevention Act requiring detailed supplier audits and documentation.

India

Strengths India’s main advantage is its cost efficiency. Low labor rates and a large skilled workforce make it ideal for categories like apparel, home textiles, basic electronics, and simple assemblies. Government programs are also supporting manufacturing growth and export capacity.

Risks

Longer shipping times to the U.S. can be a drawback, especially for seasonal or fast-moving goods. India has no free trade agreement with the U.S., so standard tariffs apply. While infrastructure is improving, bottlenecks in transport and port operations can still cause occasional delays.

Mexico

Strengths Mexico’s proximity to the U.S. allows for rapid delivery, often in under a week, which is a major advantage for companies that need to react quickly to demand changes. The USMCA agreement also provides duty-free access for qualifying goods, and cultural alignment makes cross-border business smoother.

Risks

Rising wages in Mexico may gradually reduce some cost advantages. In addition, high demand for manufacturing space in key regions has created capacity challenges, so securing reliable suppliers early is essential.

For a deeper look at the obstacles shaping global trade, see our blog on Supply Chain Challenges Businesses Face in 2025.

Make the Right Sourcing Choice with SIXM

When speed to market is a top priority, Mexico delivers strong nearshoring advantages, rapid shipping, and lower logistics risks. Businesses focused on cost efficiency can benefit from India’s low labor rates and competitive manufacturing base, especially for labor-intensive products. Companies with complex manufacturing needs should maintain China in their supply chain, leveraging its advanced infrastructure, technical expertise, and capacity for large-scale production.

At SIXM, a top-rated procurement company, we help businesses manage the complexities of sourcing with data-driven insights and on-the-ground expertise. Our team can connect you with the right partner in Mexico, India, or China to optimize for speed, cost, or advanced manufacturing, ensuring your supply chain is resilient, efficient, and ready for 2025 and beyond.