The automotive industry is a crucial sector of the economy in many regions around the world, significantly impacting economic development, employment, and technological advancement.

The automotive sector in Mexico has been dynamically shaped by its involvement with MERCOSUR countries through the Complementation Agreement No. 55 (ACE 55). This agreement, pivotal for trade relationships, strategically positions Mexico as a key player in the Latin American automotive market. While ACE 55 primarily facilitates the reduction of trade barriers and tariffs between Mexico and countries such as Brazil, Argentina, Uruguay, and Paraguay, its broader impact on the automotive industries in these regions encompasses enhanced market access, supply chain integration, and competitive market positioning.

This comparative analysis explores how the Mexican automotive industry has leveraged ACE 55 to not only boost its economic footprint but also to navigate the challenges and opportunities presented by such a significant trade partnership.

Automotive Industry in Mexico

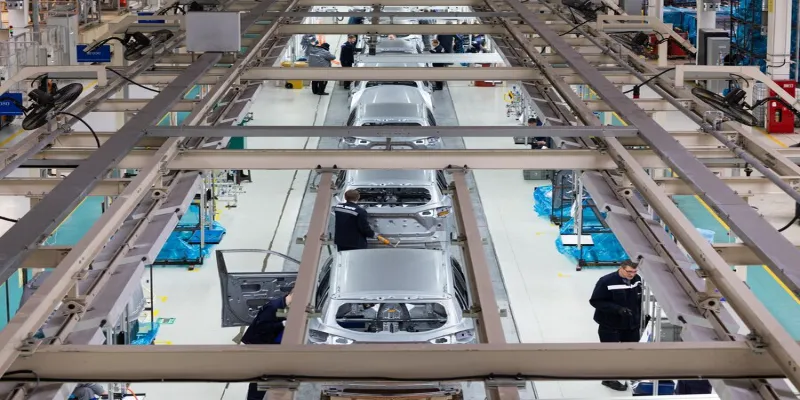

Mexico has emerged as a powerhouse in the automotive industry, primarily due to its strategic geographical location, favorable trade agreements, and competitive labor costs. The country serves as a major manufacturing and export base for vehicles and automotive parts. Key global players, such as General Motors, Ford, Volkswagen, and Nissan, have substantial manufacturing operations in Mexico. The North American Free Trade Agreement (NAFTA), replaced by the United States-Mexico-Canada Agreement (USMCA), has further bolstered Mexico's position by eliminating tariffs and facilitating smoother supply chain operations across North America.

Must Read: Mexico's Automotive Industry: Key Players and Strategic Manufacturing Hubs

Mercosur's Automotive Sector

Mercosur, consisting of Brazil, Argentina, Uruguay, and Paraguay, with Venezuela currently suspended, operates under a different dynamic. The bloc has traditionally focused on protecting its internal markets, which has influenced its automotive policies. High import tariffs and local content requirements characterize Mercosur's approach, aiming to foster local industry and reduce dependency on imports. Brazil, as the largest economy in the bloc, dominates the region's automotive production, followed by Argentina. Both countries have established robust automotive industries with extensive domestic and foreign investments.

ACE 55: Bridging Automotive Trade Between Mexico and Brazil

ACE 55 is a key bilateral agreement between Mexico and Brazil, serving as part of a broader network of economic complementation agreements designed to enhance economic ties and lower trade barriers. Initiated specifically to promote the automotive trade between the two nations, ACE 55 facilitates the exchange of automotive goods by establishing preferential trade terms. It supports the automotive sector by progressively reducing tariffs over a designated period, making it easier for both countries to share resources and market access effectively.

The Impact of ACE 55 on Automotive Trade between Mexico and MERCOSUR

Since its inception in 2003, ACE 55 has undergone numerous negotiations to decrease tariffs between Mexico and its MERCOSUR trade partners on vehicles and automotive components. A 2015 update to ACE 55 enabled gradual increases in Brazil’s imports from Mexico, targeting tariff-free access for exports of light vehicles from Mexico to Brazil by 2019. As of the latest updates in 2023, the agreement also encompasses trucks, buses, tractor trailers, and certain chassis, aiming to eliminate tariffs on these items as well.

The rules of origin within ACE 55 specify that to benefit from reduced tariffs, at least 40% of the automotive content must be locally sourced from the exporting country. This requirement supports regional production and trade, fostering stronger economic ties and enhancing the competitiveness of the automotive sectors within these nations.

Overall, ACE 55 has significantly shaped the trade dynamics between Mexico and the MERCOSUR bloc, making it a crucial element for businesses and policymakers involved in the automotive industry in these regions.

Challenges and Opportunities

The Economic Complementation Agreement No. 55 (ACE 55) between Mexico and the MERCOSUR countries presents both significant opportunities and challenges that impact the dynamics of the automotive industry in the region. Here's a detailed look into these aspects:

Opportunities

- Increased Market Access

ACE 55 provides Mexico with tariff-free or reduced tariff access to large South American markets, particularly Brazil, which is the ninth largest car market globally. This access allows Mexican automotive manufacturers to expand their market reach, increase sales, and benefit from economies of scale. -

Strengthening of Supply Chains

The agreement encourages the development of robust supply chains across member countries. By establishing rules of origin that require a significant percentage of local content, ACE 55 fosters regional production networks, supporting industries from parts suppliers to final assembly. -

Enhancement of Competitive Advantage

The preferential trade terms under ACE 55 enable Mexican automotive products to be more competitively priced in MERCOSUR markets. This competitive edge is crucial in a region where other major global players are also vying for market share. -

Promotion of Technological Advancements

With the free movement of goods, there is an increased incentive for technological innovation and upgrading of automotive products to meet diverse market standards and preferences within the trade bloc.

Challenges

- Economic Volatility

Latin American markets, including those in MERCOSUR, are often subject to economic instability, which can affect trade patterns. Political changes, economic policies, and other external factors can influence the stability and predictability of trade under ACE 55. -

Balancing Trade

While Mexico has seen a trade surplus with MERCOSUR countries, this has led to tensions, such as previous threats by Brazil to abandon the agreement due to concerns over its local automotive industry. Managing these trade imbalances requires continuous diplomatic and trade negotiations to ensure mutual benefits. -

Compliance with Rules of Origin

Ensuring that automotive products meet the local content requirements can be challenging. Manufacturers must navigate complex regulations and verification processes to qualify for tariff reductions, which can involve significant administrative burdens and costs. -

Market Competition

The removal of trade barriers also means increased competition from other MERCOSUR members and external automotive players in the region. Mexican manufacturers must continually innovate and improve their offerings to maintain and expand their market share in a highly competitive environment.

Overall, ACE 55 presents a framework that, while beneficial in fostering trade and economic ties, also requires adaptive strategies to navigate the complexities and leverage the opportunities it presents effectively.

Conclusion

The automotive industries in Mexico, Mercosur, and under ACE 55 are at different stages of development and face distinct challenges. However, each also possesses unique strengths and opportunities that can propel them forward in the global automotive arena. By leveraging strategic trade agreements, embracing innovation, and fostering regional cooperation, these regions can enhance their competitiveness and play a more significant role in the international automotive industry.

This comparative analysis highlights the complexity and dynamism of the automotive sectors in these regions, providing insights into their potential trajectories in the evolving global market.

SIXM's Role in Leveraging ACE 55 for Global Expansion

With the ever-evolving dynamics of ACE 55 and its impact on international trade, SIXM remains at the forefront of offering tailored solutions that enhance market entry strategies and compliance with trade regulations. As part of our commitment to supporting your business, SIXM offers expert guidance in navigating the complexities of trade laws and leveraging economic agreements to your advantage. Within this framework, Contract Manufacturing in Mexico emerges as a pivotal element, facilitating strategic advantages for businesses aiming to optimize their operations and extend their global reach. For a deeper understanding of how SIXM can assist in optimizing your operations and extending your global reach, get in touch with us today. Let's harness the potential of ACE 55 together and drive your business towards sustained growth and success.

Sources

North American Free Trade Agreement (NAFTA).